“This is the first time I have ever rode down this road in a car,” Wilmer chimed from the back of the bus. “This road” he mentions is the 7-mile barely passable steep and rocky road he’s lived on all his life; the only access to his remote mountain community; the one he, his family and neighbors often hike 3-hours one-way before reaching any public transportation to access markets, health care, work, etc.

It takes us about 30 minutes to drive in a 4-wheel-drive pickup, longer today because we’re in a bus loaded with 12 members of the Pajarillos community, aged 20-60, with an average of only 3rd grade level of education, all eagerly aspiring to create their own community microfinance bank. Their own “caja rural” microfinance bank can give them the means to finance microenterprise endeavors and pull themselves out of poverty. I can’t describe the excited emotion filling that bus -both within the community members and myself.

There were two buses on their way down the mountain that day (the other brought 7 more directors from the newly formed community bank in Joyas del Carballo) to our first 3-day microfinance training just outside Valle de Angeles. In this first of a three-module series, they learned a) what a “caja rural” community microfinance bank is and can be; b) requirements, roles and responsibilities for directors and members; c) how to use a calculator; d) allocation of funds; and e) introduction to the control books. Many of them had never used a calculator before, and they all got so engrossed into the practice exercises that it was hard to get them to stop for meals!

Beyond the formal training, it was wonderful to see the exchange between the two communities. Each had comprehensive experience in the type of projects the other is planning to implement soon, so it was very beneficial for them to get a chance to share ideas and hear from the other about their lessons learned. They truly opened up and grew through this experience. By the third day the timid participants were diving deep into each issue with curious questions and debates, and they were up presenting in front of the class!

These 20 participants returned home ready to put into practice what they had learned. These two microfinance groups were actually formed last December with help from a rep from the Honduran government project DICTA, but then he disappeared before providing any training or follow-up. Global Brigades doesn’t work like that, we honor long-term commitments and relationships with our communities seeking community empowerment and sustainability. We finished Module 1 with a commitment agreement of tasks to complete before the next month’s Module 2. They’ll be finalizing their board of directors and setting up the first control books. I’ll be visiting them at least twice a month with another microfinance expert to follow-up. We’ll be there to assist, answer questions, and watch them continue to grow! I love my job. Can it get any more rewarding than this?

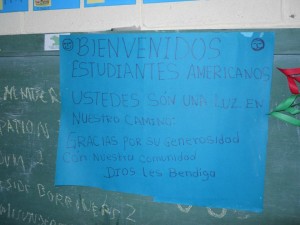

CHECK OUT PICTURES FROM MICROFINANCE TRAININGS